Smart solutions

for a sustainable future

Design studio making impact since 1989.

Smart solutions

for a sustainable

future

Design studio making impact since 1989.

Smart solutions

for a sustainable future

Design studio making impact since 1989.

Smart solutions

for a sustainable future

Design studio making impact since 1989.

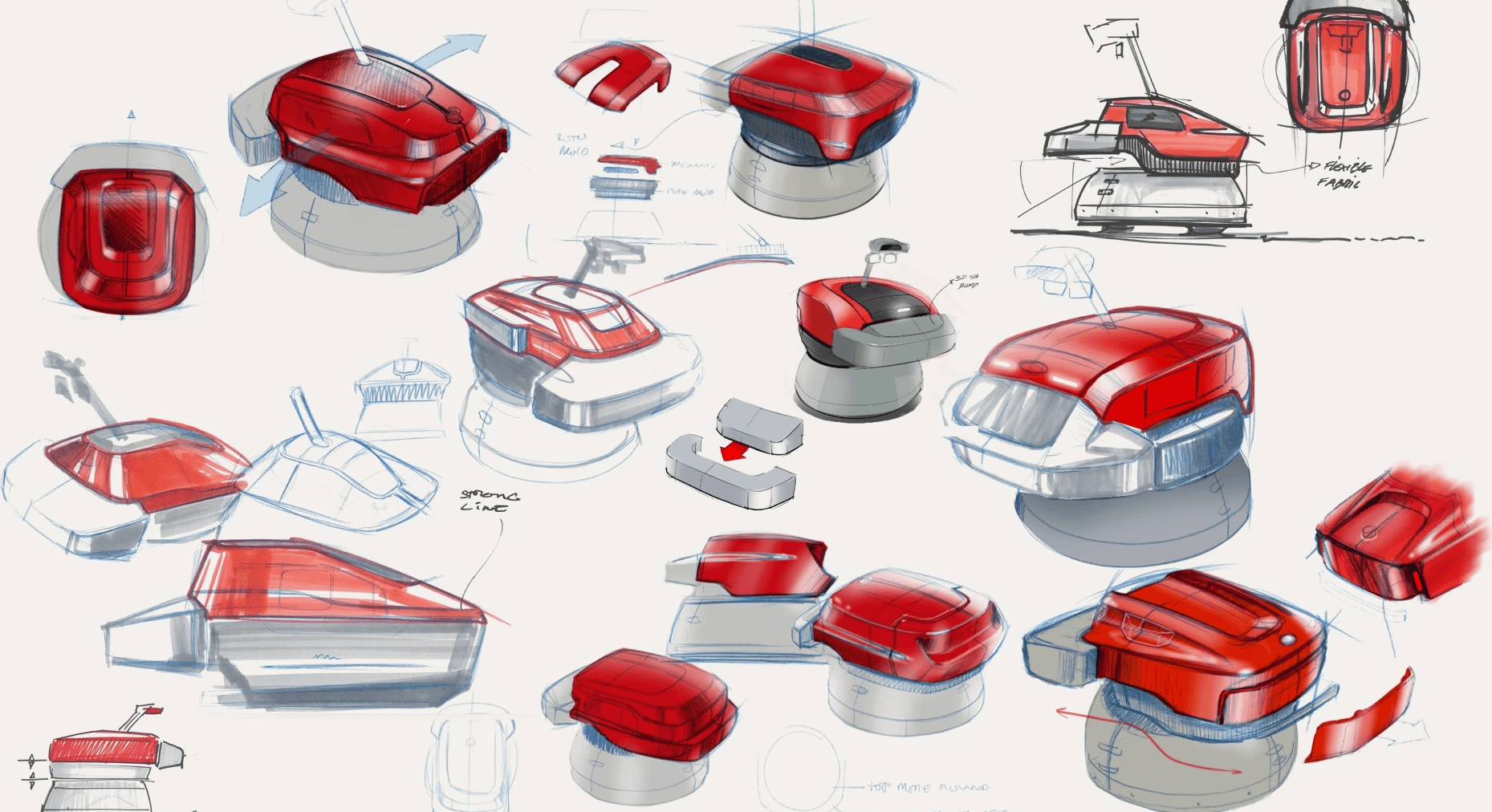

Accelerating transitions through design

At FLEX/design, we view today’s big challenges— like climate change and environmental degradation—as deeply connected issues that need bold, systemic change. Traditional approaches often fall short because they focus too much on analysis and not enough on creativity. That’s where design comes in. It helps make sense of complexity, brings people together and delivers fresh ideas for sustainable solutions. It’s not just about fixing problems—it’s about imagining and building a better future.

Design is a powerful accelerator for transitions - turning complexity into clarity. Numerous studies show that companies leveraging design to drive change often achieve greater performance and long-term impact.

Design is a powerful accelerator for transitions - turning complexity into clarity. Numerous studies show that companies leveraging design to drive change often achieve greater performance and long-term impact.

Design is a powerful accelerator for transitions - turning complexity into clarity. Numerous studies show that companies leveraging design to drive change often achieve greater performance and long-term impact.

Design is a powerful accelerator for transitions - turning complexity into clarity. Numerous studies show that companies leveraging design to drive change often achieve greater performance and long-term impact.

Some of the transitions we focus on

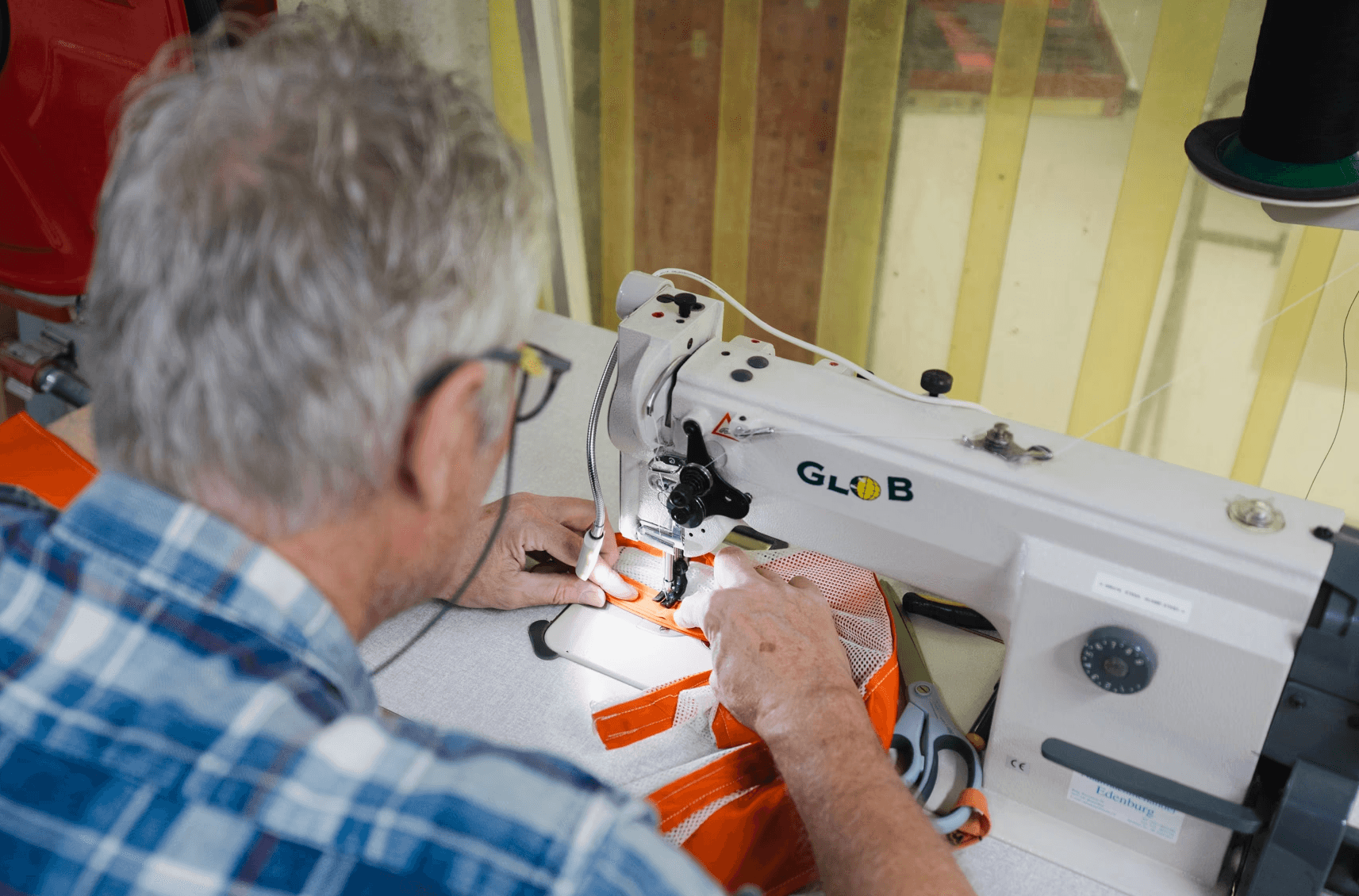

Towards local production

While local production cuts emissions by only 6%, its real impact lies in having fresher products, minimizing the need...

Towards local production

While local production cuts emissions by only 6%, its real impact lies in having fresher products, minimizing the need...

Towards local production

While local production cuts emissions by only 6%, its real impact lies in having fresher products, minimizing the need...

Towards local production

While local production cuts emissions by only 6%, its real impact lies in having fresher products, minimizing the need...

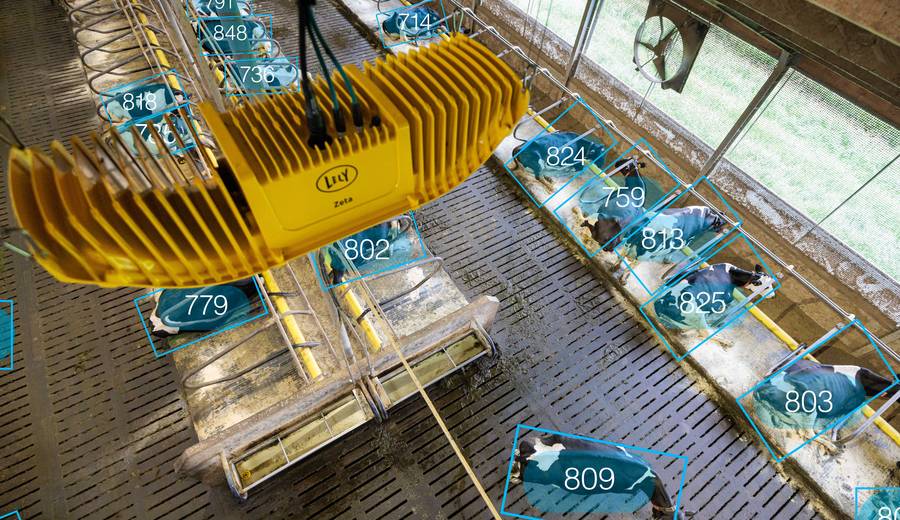

Towards smart farming

With 70% more food needed by 2050, smarter farming is essential to sustainably meet global demands sustainably...

Towards smart farming

With 70% more food needed by 2050, smarter farming is essential to sustainably meet global demands sustainably...

Towards smart farming

With 70% more food needed by 2050, smarter farming is essential to sustainably meet global demands sustainably...

Towards smart farming

With 70% more food needed by 2050, smarter farming is essential to sustainably meet global demands sustainably...

Towards circular systems

As 91% of materials are wasted, redesigning our behavior is essential to shift from a linear to a circular economy. Circular ...

Towards circular systems

As 91% of materials are wasted, redesigning our behavior is essential to shift from a linear to a circular economy. Circular ...

Towards circular systems

As 91% of materials are wasted, redesigning our behavior is essential to shift from a linear to a circular economy. Circular ...

Towards circular systems

As 91% of materials are wasted, redesigning our behavior is essential to shift from a linear to a circular economy. Circular ...

Pioneers in their field

Brands we support to accelerate towards a sustainable future

Accelerate towards

Accelerate towards

a sustainable future

a sustainable future

At FLEX/design, we recognize the responsibility that comes with being designers. We’ve made the conscious decision to place sustainability at the core of our business, believing it is our role to accelerate the transition to a sustainable future.

At FLEX/design, we recognize the responsibility that comes with being designers. We’ve made the conscious decision to place sustainability at the core of our business, believing it is our role to accelerate the transition to a sustainable future.

At FLEX/design, we recognize the responsibility that comes with being designers. We’ve made the conscious decision to place sustainability at the core of our business, believing it is our role to accelerate the transition to a sustainable future.

At FLEX/design, our team's unparalleled skill and expertise are the cornerstones of our success. We combine decades of experience with innovative thinking to consistently deliver exceptional design solutions that our clients can trust.

At FLEX/design, our team's unparalleled skill and expertise are the cornerstones of our success. We combine decades of experience with innovative thinking to consistently deliver exceptional design solutions that our clients can trust.

At FLEX/design, our team's unparalleled skill and expertise are the cornerstones of our success. We combine decades of experience with innovative thinking to consistently deliver exceptional design solutions that our clients can trust.

At FLEX/design, our team's unparalleled skill and expertise are the cornerstones of our success. We combine decades of experience with innovative thinking to consistently deliver exceptional design solutions that our clients can trust.

Join us in accelerating transitions to a sustainable future.

Join us in accelerating transitions to a sustainable future.

Join us in accelerating transitions to a sustainable future.

Contact us today to make a difference together.

Contact us today to make a difference together.